Sponsored by Ingram Insurance Group

Dayton’s Most At-Risk Neighborhoods for Storm Damage — What the Data Shows

Severe weather has long been part of life in Dayton, but in recent years residents have experienced a noticeable shift in the frequency, timing, and severity of damaging storms. Hail events have become more unpredictable, windstorms more destructive, and short-notice tornadoes more common than many longtime residents remember. While every neighborhood in the Miami Valley can be affected, new data highlights that some areas face distinct patterns of risk linked to geography, building age, tree coverage, and surrounding terrain.

This report examines the recurring storm-related exposures across Dayton’s neighborhoods and explains what the data suggests about which communities are most vulnerable — and why. The analysis is supported by insights contributed by Ingram Insurance Group, a Dayton-based agency familiar with local claim patterns and the challenges homeowners face when recovering from severe weather.

A City Still Marked by the 2019 Tornadoes

Though several years have passed since the 2019 Memorial Day tornado outbreak, its effects continue to shape conversations about risk and preparedness. The EF4 tornado that ripped through Trotwood, Harrison Township, and Old North Dayton served as a reminder that storm risk in the region is not confined to wide-open rural areas. The funnel moved directly across densely populated residential zones, damaging thousands of structures — many of them older homes with aging roofs and dated structural systems.

Insurance professionals note that neighborhoods heavily impacted in 2019 still experience higher scrutiny from carriers due to historical loss patterns. Even when reconstruction brought many buildings up to modern code standards, adjacent areas containing older, unrenovated housing stock remain a focus for underwriters evaluating wind and hail exposure.

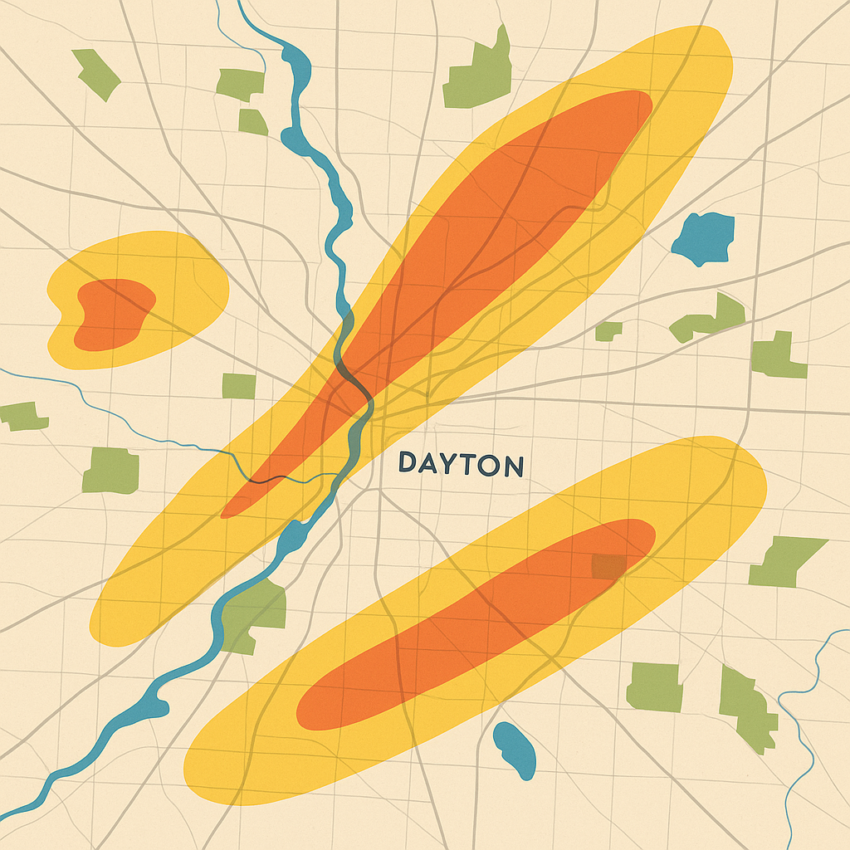

Wind Exposure: The West & Northwest Corridors

Data from recent wind events shows that neighborhoods on the west and northwest sides of Dayton tend to experience the strongest sustained gusts and the highest rates of surface-level wind damage. Residents in communities such as Trotwood, Northwest Dayton, and the residential zones extending along and beyond Salem Avenue routinely report issues such as downed power lines, lifted roof shingles, siding displacement, and fallen tree limbs. While no area of the Miami Valley is immune to high wind, these neighborhoods experience a disproportionate share of the damage during severe weather.

Several geographic and structural factors help explain this phenomenon. The topography west of Dayton opens into broader plains before dropping into lower-density, semi-rural areas. As storms move in from the west — which is the predominant direction of severe weather systems in the region — the lack of natural and man-made wind breaks allows gusts to accelerate before encountering the more tightly built residential zones of Northwest Dayton and Trotwood. By the time these storm fronts reach neighborhoods with consistent rows of mid-century homes, the wind has gained enough momentum to create significant uplift and shear forces on roofs and exterior walls.

Vegetation patterns add another layer of vulnerability. Many of the tree-lined blocks in these neighborhoods contain mature hardwoods planted between the 1940s and 1960s, long before today’s standards for spacing, pruning, and storm-hardening were widely understood. Large canopies combined with aging root systems increase the likelihood of both limb fractures and full tree failures. During severe wind events, these trees become a major contributor to collateral damage — impacting roofs, vehicles, fences, and utility lines.

The age of the housing stock also plays a critical role. Much of the residential construction in these corridors dates from the 1920s through the 1970s, an era in which roofing materials, fastening methods, and attic ventilation were manufactured to very different standards than those used today. Homes built during this period may contain original or minimally updated structural components, including rafters, gable ends, and roof decking that are more susceptible to uplift when exposed to sudden or sustained winds. In addition, older asphalt shingles — especially those nearing the end of their service life — lose adhesion and flexibility, making them significantly more vulnerable to being lifted or torn away.

According to Ingram Insurance Group, roof age is one of the most defining factors in whether a wind claim is limited to repairs or escalates to a full roof replacement. “In older Dayton neighborhoods, the difference between a 12-year-old roof and a 25-year-old roof can be the difference between a repairable claim and a total loss,” the agency notes. This disparity stems from both the degradation of materials over time and the way older roofs interact with high wind loads. Once shingles begin to detach in multiple sections, water infiltration often follows, leading to interior damage and compounding the overall cost of the claim.

These combined geographic, environmental, and structural variables create a wind-risk profile that is distinctly elevated in Dayton’s western and northwestern neighborhoods. As the city continues to age and as severe wind events become more common across Ohio, understanding these local patterns becomes increasingly important for homeowners, buyers, landlords, and insurers alike.

Hail Risk: Kettering, East Dayton & Riverside

Hail events in the Miami Valley tend to follow storm tracks from the southwest to the northeast. This pattern has historically produced higher concentrations of hail damage in Kettering, East Dayton, Riverside, and portions of Beavercreek Township. These neighborhoods often experience repeated hailstorms within short intervals. In some years, multiple storms hit the same corridors, creating cumulative wear on roofing systems even when individual storms do not trigger immediate claims.

Homes with older asphalt shingles — especially three-tab shingles — suffer the most. Granule loss, micro-cracking, and weakened seal strips accumulate over time, making future storms more damaging.

Ingram Insurance Group confirms that “policyholders in east and southeast Dayton file hail claims at disproportionately higher rates than many outer suburbs.”

Flooding & Water Intrusion: Low-Lying Creek & River Adjacent Areas

While Dayton’s levee system reduces catastrophic river flooding, neighborhood-level water intrusion remains a significant risk. The areas most consistently affected include properties along Wolf Creek, low-lying sections of Riverside and Eastmont, neighborhoods bordering the Great Miami River, and older homes built near former drainage paths, especially in East and West Dayton.

Basement seepage, overwhelmed sump pumps, and sewer backup incidents increase sharply during heavy rainfall events. Many of these problems stem from aging clay tile pipes and older foundation systems prevalent in mid-century and pre-war housing stock. As these underground lines deteriorate, they become more prone to root intrusion, cracking, and collapse — all of which reduce the flow capacity during major storms. When the soil becomes saturated, hydrostatic pressure builds along basement walls, forcing water through small gaps in masonry or through the joints of block foundations. This combination of overwhelmed drainage systems and rising groundwater levels can lead to sudden, unexpected water intrusion even in homes that have never previously experienced flooding.

Dayton’s stormwater infrastructure also contributes to vulnerability in certain neighborhoods. Much of the city’s drainage network was installed decades ago, and while it continues to function effectively under normal conditions, it can become stressed during the intense, short-duration rainfall events that have become increasingly common in recent years. In low-lying blocks or areas near historic creek beds, stormwater systems may not empty quickly enough, causing temporary backups that push water into basements through floor drains, sump pits, or foundation weaknesses.

Insurance agencies across the region emphasize that water backup coverage — often overlooked by homeowners — is one of the most frequently claimed endorsements in Dayton. Standard homeowners policies typically exclude damage caused by water that enters from below grade or backs up through drains, making this coverage critical for residents in older neighborhoods or areas susceptible to rapid saturation. Even a minor sewer or sump backup can result in thousands of dollars in repairs, especially when finished basements, HVAC equipment, or electrical systems are affected. For many local policyholders, water backup protection has shifted from an optional add-on to an essential safeguard given the changing rainfall patterns and aging infrastructure throughout the Miami Valley.

Tree Density & Structural Age: Oakwood, Grafton Hill & Belmont

Tree-lined historic neighborhoods such as Oakwood, Grafton Hill, and portions of Belmont face a unique risk profile. While these areas are not necessarily the most exposed to extreme wind, the combination of mature trees and older structural components often results in roof punctures, gutter and fascia damage, vehicle impact claims, and power outages from downed limbs.

Homes in these neighborhoods commonly feature slate or older dimensional shingle roofs, which can be costly to repair. Additionally, many structures are built close together, increasing the likelihood that a fallen tree on one property will affect a neighboring home.

Ingram Insurance Group notes that “these neighborhoods rarely have the most claims, but when they do, the severity is often higher.”

Why Some Neighborhoods Have Higher Insurance Rates

Insurance premiums do not rise or fall based on any single factor. Instead, they reflect a blend of historical claims data, structural characteristics, geographic exposure, and actuarial modeling at both the ZIP code and micro-neighborhood level. In Dayton, these variables interact in ways that make certain areas more expensive to insure, even when homes appear similar on the surface.

One of the most influential factors is the pattern of historical wind, hail, and water-related claims within a given area. When carriers see consistent losses occurring in the same neighborhoods over a period of years — particularly involving roofing, siding, or water intrusion — actuarial models adjust to reflect the heightened likelihood of future claims. These models operate on probability, not perception. Even if a homeowner has never filed a claim, they may still face higher premiums simply because surrounding properties have experienced repeated storm losses.

Building age further amplifies these differences. Dayton’s older neighborhoods contain homes with roofing systems, attic ventilation patterns, and structural elements that reflect the standards and materials of past decades. Roofs on homes built prior to the 1990s often have shorter expected lifespans, weaker wind resistance ratings, and fewer safeguards against water infiltration. When paired with repetitive storm exposure, these structural characteristics increase both the frequency and severity of damage. As a result, insurers treat aging housing stock as a higher baseline risk, which is reflected in premium calculations.

Roof condition is a particularly sensitive variable. Many carriers now apply stricter roof age rules in parts of Ohio that have seen clusters of hailstorms or wind events. In neighborhoods where storms have repeatedly tracked over the same corridors — such as sections of East Dayton, Riverside, and Northwest Dayton — insurers may require photographic documentation of roof shingles, attic ventilation, or underlayment conditions before issuing or renewing a policy. In some cases, carriers will not accept roofs older than a specific age without evidence of recent maintenance or replacement.

Storm path data also influences how insurers approach specific ZIP codes. As meteorologists and catastrophe modeling firms refine their mapping of hail swaths, tornado tracks, and wind corridors, insurers update their internal risk profiles. When models show that certain neighborhoods fall within the most frequently affected zones, premiums are adjusted accordingly. These adjustments are not arbitrary; they reflect measurable differences in hazard exposure over time.

Finally, broader actuarial trends across Ohio play a role. The past decade has seen a steady increase in the number and severity of wind and hail claims statewide. This rising loss environment has prompted carriers to scrutinize older roofs more closely, limit certain coverage types unless updates have been made, and tighten underwriting in pockets of the Dayton region with high concentrations of aged housing stock. The combination of local loss history and statewide climate trends means that some neighborhoods experience modest but noticeable upward pressure on premiums, while others with newer construction or fewer historical claims remain more stable.

In short, insurance rates are shaped by a complex intersection of local weather patterns, neighborhood infrastructure, and the evolving behavior of storms across the Miami Valley. Homeowners in areas with frequent storm activity or aging building inventory may face additional requirements or higher premiums, not as a penalty, but as a reflection of the measurable risks documented in regional data.

Preparing for a Future of More Severe Weather

Climate shifts have not bypassed the Miami Valley. Seasonal patterns have changed, and insurers now account for more frequent microbursts, straight-line winds, and heavy rainfall events. For homeowners, this means that preparation is more important than ever.

According to insights provided by Ingram Insurance Group, the most proactive steps Dayton residents can take include maintaining roofs, upgrading sump pump systems, trimming large trees, and verifying whether their policies include endorsements for water backup and full replacement cost on roofing materials.

Storm risk in Dayton is not uniform. It varies from neighborhood to neighborhood, influenced by history, terrain, and infrastructure. But with the right preparation and adequate insurance protection, residents across the city can face severe weather with greater confidence — regardless of which part of Dayton they call home.

Sponsored Message: Ingram Insurance Group

Ingram Insurance Group is a Dayton-based independent insurance agency specializing in homeowners, rental property, and small business coverage across the Miami Valley. With experience navigating the unique risks of Dayton’s diverse neighborhoods, the agency provides tailored guidance to help residents protect what matters most.

Ingram Insurance Group

733 Salem Ave, Dayton, OH 45406

Phone: (937) 741-5100

Email: contact@insuredbyingram.com

Website: www.insuredbyingram.com