The Dayton housing market continued its upward climb this fall, posting gains in sales volume, home prices, and new listings—signs that the region remains one of Ohio’s most resilient real estate markets. While the national housing picture remains mixed, Dayton stands out for its combination of affordability, economic momentum, and steady buyer activity.

This month, we break down the latest numbers from Dayton REALTORS®, explain what they really mean for local homeowners and investors, and provide insight into how these trends will shape your decisions heading into 2026.

Dayton Housing Market Shows Signs of Strength in October 2025: What It Means for Buyers, Sellers, and Investors

📈 October at a Glance: Sales, Prices, and Inventory All Move Up

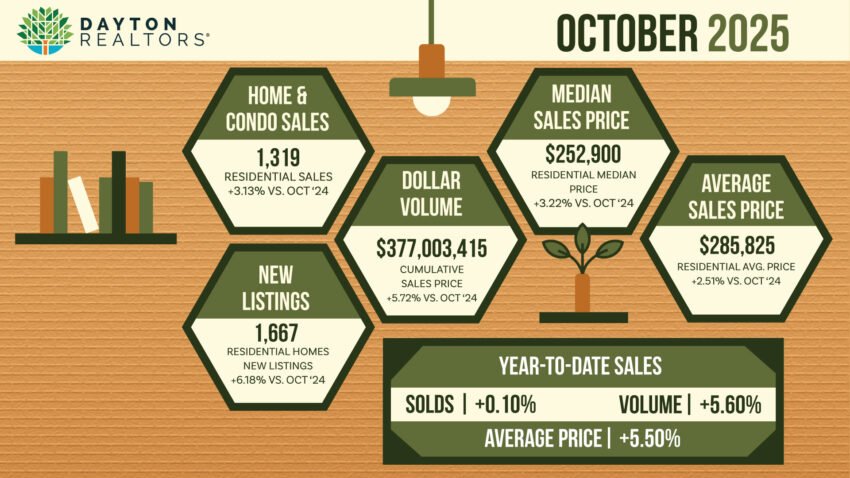

According to the newly released Dayton REALTORS® market report, the region posted strong year-over-year gains across several key categories. You can read the full report here: Dayton REALTORS® October 2025 Market Report.

Key Highlights from the October 2025 Report

From the latest data, several metrics stand out:

- 1,319 homes sold in October — up 3% from October 2024.

- $377 million in total sales volume — a 5.7% increase year-over-year.

- Median sale price: $252,900 — up about 3% from last year.

- Average sale price: $285,825 — up roughly 2.5%.

- 1,667 new listings — a 6% increase, showing more sellers are re-entering the market.

Looking at the year-to-date numbers through October:

- 12,330 total sales, just edging out last year’s 12,318 closings.

- Average year-to-date sale price: $293,461, up about 5.5%.

- Median year-to-date sale price: $255,000, up more than 6%.

- 2,623 active listings at month’s end, representing about 1.9 months of supply — still a strong seller’s market, but slightly looser than last year’s 1.8 months.

🏡 Why These Numbers Matter for Everyday Dayton Residents

1. More homes are finally hitting the market.

A 6% jump in new listings means buyers have a bit more breathing room—something Dayton hasn’t seen consistently since the height of the pandemic housing surge. While it’s nowhere near a “buyer’s market,” it does create more choice and slightly less pressure for those actively shopping.

2. Prices continue to rise, but at a sustainable pace.

Price growth in the 2.5–6% range is high enough to be healthy, but not so high that it completely shuts out first-time buyers. For current homeowners, it’s a reassuring signal that equity is still building. For would-be buyers, it’s a reminder that “waiting for prices to drop” may not be a winning strategy in the Miami Valley.

3. The market’s momentum is real.

For most of 2025, closings lagged behind 2024. The fact that year-to-date sales finally pulled even and then surpassed last year tells us buyer activity is strengthening heading into winter—normally one of the slower seasons. That sets the stage for a potentially strong 2026, especially if interest rates cooperate.

🏘️ What This Means for Dayton Investors

Dayton’s investor community—from local landlords to out-of-state buyers—will pay close attention to three big signals in this report:

✔ Rents are likely to continue rising.

Limited supply and higher home prices push more people toward renting, particularly those who are priced out of homeownership or waiting for better mortgage rates. That trend benefits already-established landlords across the region.

✔ Strong resale prices support equity growth.

With the year-to-date median price up more than 6%, investors holding property in the Miami Valley are seeing steady equity growth on top of cash flow. That combination is exactly why Dayton has become a favored market for long-term buy-and-hold strategies.

✔ Inventory growth means more opportunities.

The bump in listings presents a chance for investors who spent much of the last three years losing bidding wars. While competition remains, more inventory makes it easier to find deals that pencil out—especially for those willing to look at value-add properties or emerging neighborhoods.

🏡 For Sellers: It’s Still Your Market

Dayton remains well below the typical “balanced market” benchmark of 5–6 months of inventory. With just 1.9 months of supply:

- Homes priced correctly are still selling quickly.

- Multiple-offer scenarios remain common in desirable neighborhoods.

- Properties under $300,000 continue to see the strongest demand.

If mortgage rates fall further in early 2026, expect even more competition from buyers who are currently waiting on the sidelines. That could put additional upward pressure on prices, particularly in entry-level and mid-range segments.

🧭 For Buyers: Prepare and Act Fast

Even with more listings, this is still a tight market. Buyers should be ready to:

- Get pre-approved before touring homes.

- Move quickly on competitively priced properties.

- Consider neighborhoods slightly outside their initial target for better value and less competition.

In today’s Dayton market, a prepared buyer working with a responsive local agent still has a real advantage, even in multiple-offer situations.

🌐 Zooming Out: Why National Policy Is About to Matter More Than Ever

While Dayton’s local market metrics tell a compelling story on their own, broader national policy changes could amplify these trends significantly.

The Federal Reserve just ended Quantitative Tightening (QT).

Effective December 1, the Federal Reserve officially halted its Quantitative Tightening program—the multi-year process of shrinking the money supply and reducing its balance sheet. This doesn’t mean an immediate return to money printing or Quantitative Easing (QE), but it does mean the constant pressure of liquidity withdrawal is over.

That shift alone provides some relief to credit markets, long-term bond buyers, and—critically—the volatility we’ve seen in mortgage rates.

Markets are expecting another rate cut in December.

Looking ahead to the Federal Reserve meeting scheduled for December 9–10, 2025, markets are still anticipating another 0.25% interest rate cut from Chair Jerome Powell and the FOMC. While nothing is guaranteed until the official decision is released, traders and major institutions have largely priced in the possibility of a December cut.

If that cut materializes, mortgage affordability will improve further, potentially pulling more buyers back into the housing arena across the Miami Valley.

What this means for Dayton real estate.

The way the market is currently poised, a meaningful drop in mortgage rates could have a powerful ripple effect:

- Lower rates bring more buyers back into the ring.

- More buyers increase competition for a still-limited pool of homes.

- Increased competition puts additional upward pressure on prices.

Even in the “slower” market the Miami Valley experienced over the last year, home prices have continued to climb. The October numbers make that clear: whether you look at monthly or year-to-date data, prices have marched steadily upward. If financing becomes more affordable, Dayton could see an additional surge in home prices as sidelined buyers jump back in.

🛡️ Protecting Your Investment: A Shout-Out to Ingram Insurance Group

Rising home values are good news for homeowners and investors, but they also raise an important question: is your insurance keeping up?

Ingram Insurance Group, an independent agency based here in the Miami Valley, offers competitive home insurance rates for Dayton-area homeowners and landlords. Because they work with multiple carriers, they can shop the market on your behalf and help you:

- Ensure your dwelling coverage reflects current rebuild costs.

- Review deductibles, roof coverage, and wind/hail protections.

- Protect rental properties with proper landlord and loss-of-rents coverage.

If you haven’t compared your home or rental property insurance recently, this market is a smart time to do it. Visit Ingram Insurance Group to request a quote.

🏡 Buying or Selling? Consider PC Title Pros

If you’re preparing to buy or sell a home anywhere in the Miami Valley, having the right title company can make your transaction smoother, faster, and more secure. PC Title Pros is a trusted local title agency that helps buyers, sellers, and investors navigate closings with confidence.

Whether you’re a first-time buyer, seasoned investor, or listing your home in today’s competitive market, PC Title Pros offers:

- Accurate and efficient title searches

- Smooth, timely closing coordination

- Responsive support for all parties involved

To learn more or schedule your closing, visit PC Title Pros.

📊 The Dayton Report’s Take: A Market Poised for a Strong 2026

The combination of local strength and improving national financial conditions sets the Miami Valley up for a potentially powerful year ahead. The end of QT and a possible December rate cut could open the door for buyers who have been sidelined by affordability constraints throughout 2024 and 2025.

Dayton continues to distinguish itself from larger metros where affordability has collapsed. Our region remains one of the Midwest’s most stable and opportunity-rich housing markets for families, young professionals, and investors.

The Dayton Report will continue tracking the market monthly and offering deep, local analysis that goes beyond the raw numbers—so homeowners, renters, and investors alike can make informed decisions in a fast-changing environment.

📍 Recent Dayton Report Highlights: Strong Sales Across the Miami Valley

The latest Dayton REALTORS® numbers reflect exactly what we’ve been documenting on The Dayton Report: real momentum, strong buyer activity, and impressive sales across multiple neighborhoods. Here are a few of the standout stories from the past several weeks:

- 10 Reasons West Dayton Is Quietly Becoming Dayton’s Best Real Estate Opportunity in 2025–2026

- West Dayton’s Housing Momentum Continues: 190 Folsom Drive Sells for $365,000

- Northwest Dayton Scores Again: 1930s Burroughs Drive Beauty Sells Over List Price

- Renovated Home Near Hillcrest Avenue Sells in Just 19 Days — Another Win for Northwest Dayton

- Renovated Cape Cod at 3108 Campus Drive Sells Above Asking, Signaling Continued Momentum in 45406

- Stunning $750,000 Sale Sets a New Bar in Farmersville

- 5.4 Acres, Privacy, and Country Living: New Madison Home Sells for $342,400

- 901 Olde Sterling Way, Dayton, OH 45459 – Washington Township Appreciation Spotlight

- 1529 N Euclid Avenue, Dayton, OH 45406 – University Row Market Spotlight

These stories illustrate what the data is telling us: buyers are active, quality homes are commanding strong prices, and neighborhoods across the Miami Valley are experiencing meaningful appreciation. Expect more success stories as we move into 2026.